Ireland’s recent €85bn bail-out package negotiated with the IMF and the EU is discussed in terms that verge on the apocalyptic. The rescue was supposed to serve as a break against the wildfire of market bondholder panic. And yet the upward trend in Portuguese bond rates has scarcely been slowed. Beyond Portugal is the much larger Spanish economy. Portugal, like Greece and Ireland, could probably just about be rescued within the terms of the current emergency scheme. It is becoming increasingly possible that the bond markets may make it too difficult for the Spanish government to refinance its loans and to raise new money on government bonds. If this were to happen, the European Financial Stability Fund would come under extreme pressure. And worse, if it is not possible to restore confidence in the stability of the Euro, there seems little reason why other countries may not also be in trouble. Spain is now where the line in the sand must be drawn. But we have heard this before. If Spain is vulnerable, why not Italy; and if Italy, why not Belgium, perhaps even France. Little wonder that the imagery of contagion, of financial plague, is brought into play.

The suddenness of the Irish deal has taken public opinion by surprise, causing shock that we have been plunged into this regime of austerity, and a smouldering anger about the terms on which the deal has been done. The terms of the bail-out will transfer all the hardships onto the taxpayers and citizens: reactions include the views that we have been held to ransom, we cannot afford this rescue package, it is a bad deal for Ireland.

Ireland’s fiscal crisis is largely caused by the collapse of the house price bubble and over-reliance on revenues from construction-related activities. This is bad enough, but by itself it would be difficult but manageable. The millstone around the neck of the Irish people is the vast scale of the crisis in the banking sector. Ireland’s banking crisis is not primarily about complicated and risky financial products: it is a common-or-garden result of reckless lending for property development and an inadequate regulatory regime. Between 2004 and 2007, the banks had escalated the scale of their lending to construction and property development enormously. When financial meltdown was imminent in September 2008, the government undertook to guarantee all of the banks’ losses, bondholders as well as depositors. In what is now widely regarded as a terrible mistake, the government in effect socialized the enormous private debt of the banks.

The true picture of what is entailed has been slow to emerge. The government’s attempts to shore up the banks have not involved outright nationalization, but the creation of a National Asset Management Agency (NAMA) to transfer the bulk of the banks’ non-performing property-backed loans into a special purchase vehicle, at a discounted rate. This amounts to indirect recapitalization of the banks. The total cost of Nama-type loan loss is now estimated at €66 billion. This is, in effect, half of GNP (the best measure of the taxable resource base of the Irish economy), which in 2009 amounted to €131.2bn. Mortgage and personal loan losses have not yet come fully into focus, but may amount to an additional €25 billion.

The present government, a coalition between the dominant centre-right Fianna Fáil and the Green Party, must go to the polls soon, and they will certainly be trounced. But unpopular though it is, the government was adamant until almost the last moment that it did not need or ask for the rescue package. Borrowing needs were fully met until mid-2011, and government had no need to go back to the bond markets. ECB as well as European Commission representatives had been on an extended visit to the Department of Finance, inspecting plans for the budget due on 7 December, in line with the strengthened fiscal oversight practices in the Eurozone. EU Commissioner for Economic and Monetary Affairs Olli Rehn had declared himself happy with the plans he had seen. Austerity measures were projected to take some €4bn out of the economy as part of the planned fiscal consolidation strategy. This was intended to ensure conformity with the Stability and Growth Pact requirements of 3% deficit by 2014.

Yet Ireland is now committed to an IMF-EU rescue package worth €85bn over the coming years, to fund both government spending and to support the costs of sorting out the crisis in the banks. It all happened very quickly, and indeed one government minister said they were bounced into it. The terms are set out in the government’s new four-year fiscal plan. The interest rate involved is not low, at an average of 5.87%. The total fiscal contraction will come to €15bn, though the deadline is now extended until 2015. The December budget alone will take out €6bn in a mix of spending cuts and tax increases. This is tougher than anything that had been envisaged so far. In addition, the National Pension Reserve Fund, a rainy-day measure set against future public pension liabilities, is to be used as part of the bail-out package. Most controversially from the point of view of Irish taxpayers, while these public assets are to be committed to the front line of bank recapitalization, the banks’ bondholders are not to be required to bear any losses. The most equitable adjustment measure, from the point of view of the Irish taxpayers, would have required some element of writing down outstanding debt through an orderly restructuring, that is, burning the bondholders. But this could damage government’s capacity to raise future funds through borrowing; government ministers stress that they really had no option in this. Yet there is palpable anger in Ireland at the outcome which ensures that the banks will be bailed out while the cost is to be borne in full by the taxpayers.

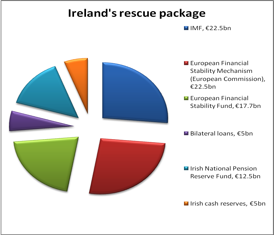

The composition of the rescue package is shown below:

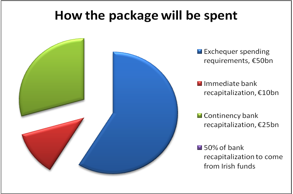

Most of the funding is to be committed to supporting government spending. A chunk will go straight into the banks immediately, while another chunk will be held as a reserve.

The way the rescue package is to be used is shown in the figure below:

Governments must adopt a whole series of highly unpalatable measures at least until 2015.Yet the plan will only work if real GDP grows by 2.75% each year. The depressing effect of extreme fiscal austerity makes this target look extremely difficult.

How did it come to this? And given the size of the intervention, why have the bond markets not been assuaged? Ireland was meant to be the firebreak in asserting the primacy of political commitment to the Euro over market irrationality. But this did not work. Instead Ireland got burned.

The explanation has to do with the fragmented sources of authority involved in managing the Euro, and the competing imperatives each of them needs to attend to.

The ECB intervened suddenly in response to the sharp rise in interest rates on Irish bonds, not because Ireland needed the deal, but because the ECB needed to stem uncertainty. It would seem that senior bank bondholders were exempted from taking any share of the pain at least in part because of the scale of the potential exposure of the German banks to Irish losses.

Interest rates spiked because German and French leaders are now openly working toward putting the current emergency rescue measures on a more permanent footing. This will mean involving senior bondholders in unwinding any future defaults, consistent with IMF practices, but the plan will only take effect after 2013. But Angela Merkel’s open speculation now about the conditions for future default had the effect of further unsettling current investors. Moreover, if default is explicitly accepted as a possibility, the Euro could become as unstable as the European Monetary System was during the 1980s.

Angela Merkel has other problems too: German popular opinion is restive about what is seen as a one-way flow of German taxpayers’ money to the troubled periphery. The result is that her public statements, issued for different audiences, seem to lack consistency.

And yet financial difficulties are not a natural phenomenon like disease, nor are they spread through diffusion like fire. Bondholders and investors may exhibit a herd mentality and act from ‘animal spirits’, but they are not incapable of reasoning. Market uncertainties are the aggregate outcome of a host of assessments about risk and about growth.

The European fire-fighters seem to be at least one step behind the game on both of these issues. Bail-outs and safety nets are crisis measures, not for the long term; but planning for a stable resolution regime is causing its own uncertainties. Harsh and even punitive fiscal measures to address what are really financial and not fiscal crises will further depress growth in the European periphery. The only realistic prospect for generating new growth in the Eurozone is if Germany were to engage in demand-enhancing measures, not the fiscal contraction to which is now seems committed. There is little prospect of this happening at the moment.

Europe seems fated to a series of attempted fire-fights, one a time, without any clear prospect of stabilization in view. Meanwhile, Irish citizens look around at their scorched fiscal landscape in dismay.